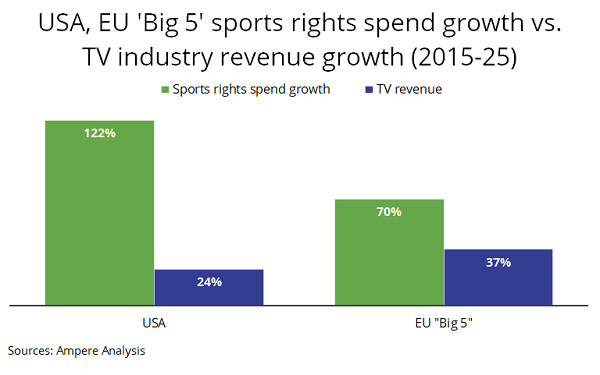

Spending on U.S. sports rights has more than

doubled in the past decade, underscoring the outsized value of live sports in an era of streaming wars and fragmented audiences. According to new research from Ampere Analysis, U.S. broadcasters and streamers will spend $30.5 billion on sports

rights in 2025, up 122% from $13.8 billion in 2015.

By comparison, overall TV industry revenues (including broadcast, cable and streaming) have grown just 24% over the same period, from $172

billion to $213 billion. That means sports rights spending has expanded five times faster than the broader market.

As a result, sports rights now consume 14% of total U.S. TV revenue, up from

8% in 2015.

NFL and NBA Deals Drive Market Surge

The surge has been powered by landmark rights renewals, particularly the NFL’s long-term deals signed in 2023 and the NBA

contracts beginning in the 2025–26 season. Networks and streamers view these marquee properties as critical to retaining subscribers, securing advertising dollars, and differentiating their

offerings from rivals.

Live sports remain one of the few reliable engines for both subscriber growth and retention, said Ampere’s analysts, noting that even as overall TV viewership

fragments, demand for premium sports has proven remarkably resilient.

Europe Charts a Different Path

Across the Atlantic, the picture looks far more restrained. In the U.K.,

sports rights spending has grown at twice the pace of TV revenue since 2015, while in Spain the multiple is 1.6. But in France and Germany, rights growth has largely stalled.

Between 2019 and

2025, TV revenue growth outpaced sports rights spending across all of Europe’s “big five” markets. The U.S. trend was the reverse, with rights costs rising at four times the rate of

total TV market growth.

Industry observers say European broadcasters are taking a more cautious approach, constrained by declining linear viewership and slower growth in streaming

subscriptions.

Implications for the Future

The Ampere data highlights the growing pressure on U.S. media companies to balance escalating sports costs with profitability

challenges. While live sports remain a reliable draw for advertisers and subscribers, the question is how long the industry can sustain rights inflation far outpacing revenue growth.

Sports

rights are increasingly central to the U.S. TV economy, the report said, but the divergence with Europe suggests broadcasters elsewhere are more skeptical about the long-term returns.