Entrepreneurs and small and medium-sized business (SMB) owners like you have many decisions to make while starting a business. Should you go for a Limited Liability Company (LLC) or a Corporation (Corp)? A sole proprietorship or a partnership?

There are many choices to make as you set out on your business venture, but we’re here to help you decide on becoming an LLC and what it means for you. We’ll explore what an LLC is, how it differs from other business structures, and the pros and cons to consider.

What you’ll learn:

- What is an LLC?

- Different types of LLCs

- How are LLCs taxed?

- How can SMBs choose the right LLC?

- Common challenges and solutions of an LLC

- How to form an LLC: a step-by-step guide

- Scaling your LLC with Salesforce

What is an LLC?

A limited liability company (LLC) is a business structure where the owners (called members) aren’t personally responsible for the company’s debts or legal issues and their personal assets are protected. LLCs also offer tax benefits and have fewer rules and requirements compared to corporations, making them a good choice for SMBs. In simple terms, an LLC protects your personal assets from a lawsuit.

This business structure is regulated by individual state laws, which vary significantly for every state. Unlike other business entities, an LLC minimizes administrative burden while providing solid protection

Key components of an LLC

The three main components of an LLC work together to provide a flexible and protective framework for managing a business. Let’s understand more about these.

Members: The owners of an LLC are called “members.” An LLC can have one member (single-member LLC) or multiple members (multi-member LLC). This involves membership interests, including each member’s ownership stake, typically expressed as percentages determining voting rights and profit distribution proportions.

Limited liability: This is a core feature of an LLC and protects members’ personal assets from business debts and liabilities. This protection provides a safety net for LLC owners, allowing them to focus on growth and value generation.

Operating agreement: This document outlines your LLC’s ownership structure, management responsibilities, and operating procedures. It helps prevent misunderstandings and clarifies profit and loss distribution. Plus, it establishes a process for decision-making and ownership changes.

Start with SMB Basics

LLC compliance and requirements

LLCs have compliance obligations, which vary by state. You can consult a business attorney or tax professional to learn about state and federal requirements. Here are the most common compliance requirements.

- Tax reporting obligations: You must file annual federal tax returns based on your chosen tax classification, such as partnership, sole proprietorship, S corporation, or C-corporation.

- Registered agent: LLCs must maintain a registered agent with a physical address in the state of formation. The agent receives official legal and tax documents for the business.

- State filing requirements: Most states require LLCs to file annual reports or statements with the Secretary of State. These reports typically include updated business information, address, and registered agent details.

- Business licenses and permits: LLCs should have all necessary licenses and permits specific to their industry and location. You must track expiration dates to ensure continuous compliance.

- Employer obligations: You should comply with federal and state employment laws, including payroll taxes, workers’ compensation, and insurance if you have employees

- Record-keeping requirements: You should maintain accurate financial records, including income statements, expense records, tax documents, and meeting minutes. Salesforce Financial Services Cloud is a centralized platform to simplify client relationships and financial operations and help with growth insights and data security.

Benefits of an LCC for SMB

With over 21.6 million LLCs in the U.S., LLCs are growing by the day. These benefits will tell you why.

- Asset protection: This is a big one. As your SMB grows and takes on more growth opportunity risks, an LLC separates your personal assets from your business liabilities, debts, and lawsuits.

- Tax flexibility: LLCs offer flexible taxation options, allowing you to choose the structure that best suits your business needs. It minimizes your tax burden as you grow.

- Simple administration: LLCs generally have simpler compliance requirements and less paperwork than corporations. This gives you more time to focus on scaling your business.

- More credibility: LLCs lend a sense of legitimacy and professionalism to your business. This is helpful while seeking funding, attracting customers, or partnerships as you grow.

- Flexible ownership structure: LLCs enable flexible ownership. You can bring new partners or investors more easily as your business scales and needs change.

Different types of LLCs

When forming an LLC, you have a choice between two main types. Let’s explore each one and see which might be the best fit for your business.

Single-member LLC: A single-member LLC is ideal for solopreneurs who want legal protection without complicated administrative requirements. You can report business income and expenses directly on your personal tax return, avoiding the complex corporate tax filing process. A freelancer or consultant could choose this option.

Multi-member LLC: A multi-member LLC is ideal if two or more individuals run a business while sharing ownership, responsibilities, and profits. This structure protects personal assets but requires a formal operating agreement to define ownership and management responsibilities. For example, a group of doctors starting a clinic together might choose this type of LLC.

Different management structures

All LLCs operate with varying structures of management. The following two structures will give you a brief idea.

Member-managed LLC: The members are directly involved in the daily operations and decision-making of the business. Let’s look at its pros and cons so you can figure which one fits your SMB.

Manager-managed LLC: The members appoint one or more managers to handle the day-to-day operations. Here are the pros and cons of choosing a manager-managed LLC.

How do LLCs differ from other business structures?

You should ideally know how LLCs fare against other business structures to make a choice. Here are the main differences.

- LLC vs. Corporation: In corporations, people invest capital to earn certain shares in a company. LLCs offer greater flexibility in taxation and management than corporations. With an LLC, you have more freedom in choosing your tax and business structures. Corporations have a more rigid structure with stricter compliance requirements and are subject to double taxation.

- LLC vs. Partnership: A partnership is when individuals combine their capital, expertise, and property to run a business, dividing profits and losses among themselves. One of the key advantages of an LLC over a partnership is the liability protection it provides to all members. In an LLC, members are safe from business debts and lawsuits. In some partnerships, partners may face personal liability for business obligations.

- LLC vs. Sole Proprietorship: A sole proprietorship is a business structure where a business is run independently. It’s the simplest business structure to set up, but offers minimal liability protection to the owner. An LLC provides a crucial separation between personal and business assets, safeguarding your finances. Besides, they provide more tax flexibility.

How LLCs are taxed

LLCs offer flexible taxation options that allow business owners to choose how they want to be taxed by the Internal Revenue Service (IRS). Let’s look at the most common options.

Single-Member LLC for simple tax reporting

For LLCs with one owner, the IRS treats the business as a “disregarded entity.” The owner reports all business income and expenses on their personal tax return using Schedule C of Form 1040. This simplifies tax reporting and is advantageous for SMBs.

Multi-Member LLC for partnership taxation

An LLC with multiple members is typically taxed as a partnership by default. The LLC must file a Form 1065 to report the business’s total income, deductions, and each member’s share of profits and losses. Each member receives a Schedule K-1 that details their share of the business’s financial activity, which they then use to report income on their personal tax returns.

S Corporation for better tax savings

LLCs can apply for S corporation status to reduce self-employment taxes. Owners can receive a salary (subject to payroll taxes) and additional income as distributions. This option allows for more flexible tax planning but has more complex reporting requirements.

C Corporation for a separate tax entity

LLCs can be taxed as C corporations, creating a separate tax entity from its owners. This option involves corporate-level, and double taxation, such as corporate income and shareholder dividend taxes. This offers advantages like easier capital raising, lower corporate tax rates, and retaining earnings within the company.

How to choose the right LLC

When selecting an LLC structure, you should assess your business needs and factors like tax implications, management complexity, and growth potential. Having answers to the following questions might help.

- How many owners will my LLC have?

- How will decisions be made?

- How will profits and losses be distributed?

- What are my long-term goals?

You can also consult a business attorney or tax professional to navigate the nuanced differences between these structures. They can help you choose an option that provides optimal legal protection, tax efficiency, and operational flexibility.

Common challenges and solutions of an LLC

LLCs experience a wide range of concerns — from operational challenges to compliance requirements. Let’s understand how to manage some common challenges.

Financial: Businesses often face difficulties with cash flow and securing capital. LLCs, especially those with limited resources, can struggle to balance expenses, investments, and funding needs.

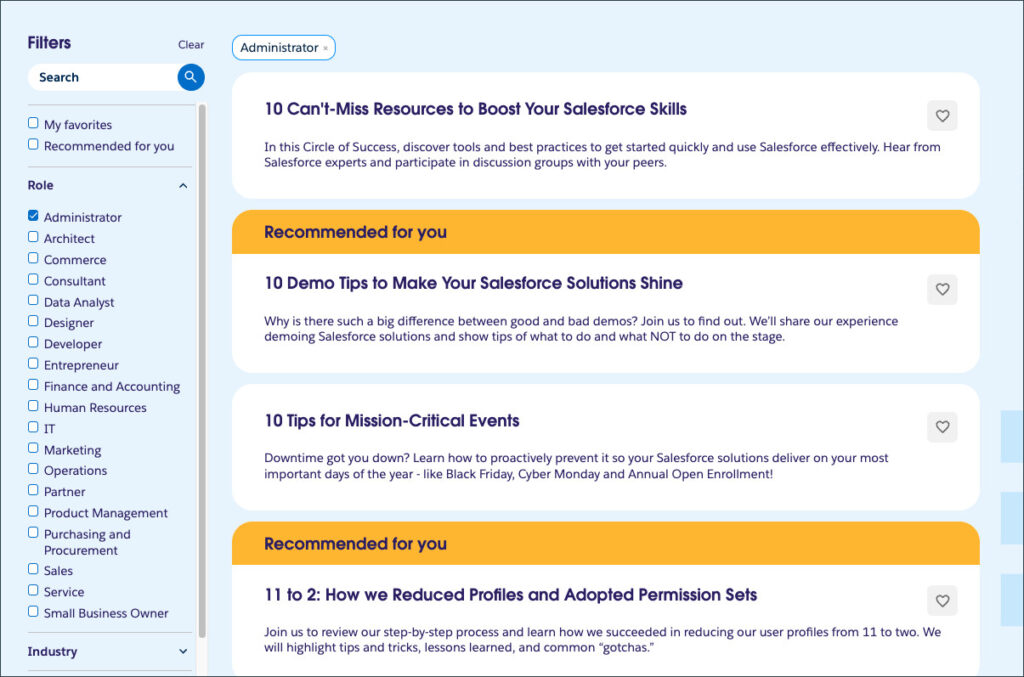

Solutions: A customer relationship management (CRM) tool gives you a 360-degree view of your financial health. It can predict cash flow, identify potential shortfalls, and optimize spending.

Technological: Many SMBs face significant obstacles in shifting to modern technology due to budget constraints and limited technical expertise. The lack of advanced tech creates a disadvantage against large enterprises.

Solutions: Go for a CRM for SMBs as it offers access to enterprise-grade software without significant upfront investment.

Scalability: LLCs often face unique challenges when scaling their operations. This can include growing the business and retaining or attracting talent.

Solutions: Look for an integrated tool that encourages better communication among teams. It should centralize information, track interactions, and foster collaboration through shared tools and notifications.

Cybersecurity: With limited resources for security measures, SMBs are prone to cyber threats. The lack of dedicated IT security teams makes them easy targets for cybercriminals.

Solutions: Look for a cloud-based solution with artificial intelligence (AI) capabilities, as it can detect and prevent threats, even without dedicated IT teams.

Compliance: Failing to meet compliance requirements can result in penalties and legal issues. With rules and regulations changing in every state, LLCs should pay close attention to compliance.

Solutions: You might want to consider an AI CRM as it provides up-to-date legal and compliance guidelines. It can also help you maintain and organize records to stay compliant.

Grow Your Small Business With AI Agents

Learn how autonomous AI can scale your small business for efficient growth in our free e-book.

How can Starter Suite help?

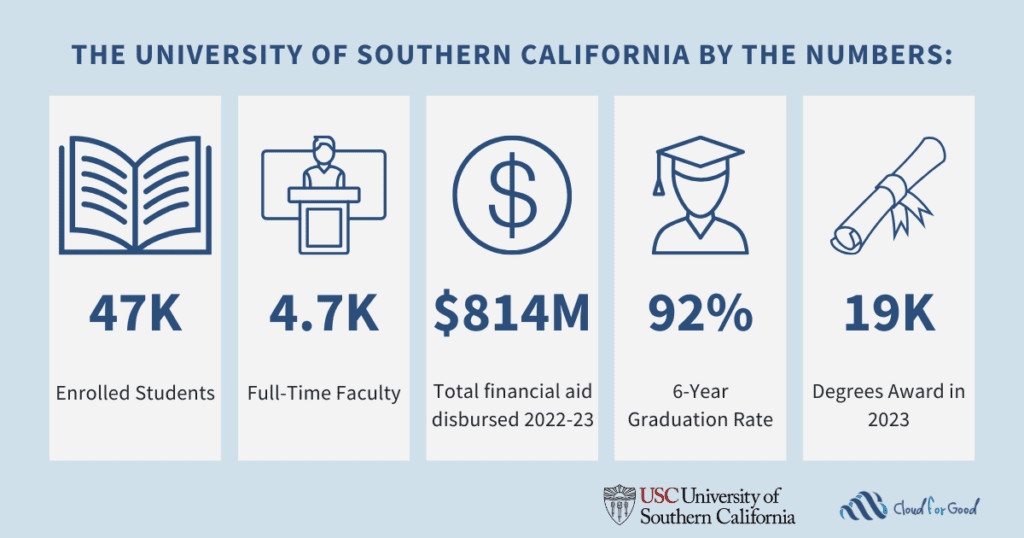

Did you know that 76% of SMBs are investing more in technology now than before? Because it helps them adapt faster and stand out in the competitive landscape. Starter Suite provides affordable and accessible CRM for startups. It makes scaling easy with intuitive marketing, sales, commerce, and service tools. Running a lean team? Think of all the possibilities and the time you’ll have on your hands. And, the following numbers prove this.

Source: Small and Medium Business Trends Report, 6th Edition, Salesforce

Whether you want to manage your deals and get insights or set up a knowledge base to make sure your customers can resolve their common concerns quickly — Starter Suite offers multiple tools. Also, it comes with built-in guidance to ensure you can navigate and utilize these tools effectively.

Just get started.

No matter where you are on your journey as a small business owner, you can get started with Starter Suite — the all-in-one AI CRM your SMB needs.

How to form an LLC: A step-by-step guide

All set to get started? Here are the eight steps you can follow to form an LLC.

- Select a unique business name: Choose a unique name that resonates with your brand and adheres to your state’s naming regulations.

- Appoint a registered agent: Designate a registered agent who’ll receive and manage all legal correspondence for your LLC.

- File with your state: File your Articles of Organization with your state’s business filing office, officially establishing your LLC.

- Create an operating agreement: Create a comprehensive operating agreement outlining your LLC’s rules, members’ responsibilities, and procedures. You can also consult a legal counsel for this step.

- Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS if you plan to hire employees or operate as a corporation or partnership for tax purposes.

- Open a business bank account: Separate your business finances from your personal finances by opening a dedicated business bank account. This can streamline your small business accounting.

- Apply for licenses and permits: Secure all necessary licenses and permits required to legally conduct your business operations.

- Register for state taxes: Register with your state’s tax agency to comply with state tax requirements.

Scaling your LLC with Salesforce

An LLC offers a solid foundation for SMBs to scale and grow. As it provides flexibility and ease of management, you can focus on what matters most: building your business. The right tools, like Starter Suite can help your LLC thrive and grow. And you get the best of all worlds — sales, support, AI, and collaboration. Start your journey with Starter Suite today.

Looking for more customization? Explore Pro Suite. Already a Salesforce customer? Activate Foundations to try Agentforce today. (Back to top.)

AI supported the writers and editors who created this article.

Frequently Asked Questions (FAQs)

LLC stands for Limited Liability Company. It’s a type of business structure that combines the flexibility of a partnership with the liability protection of a corporation.

The biggest benefit of an LLC is the limited liability protection it provides. It safeguards personal assets from business debts and lawsuits, while also offering pass-through taxation to avoid double taxation.

To form an LLC, choose a unique name, file Articles of Organization with your state, and create an Operating Agreement. Also obtain any necessary licenses and permits.

Yes, an LLC can have one or multiple owners, known as members. Single-member LLCs are owned by one person, while multi-member LLCs have two or more owners. The operating agreement will detail how the business is managed and how profits and losses are distributed.

LLCs are pass-through entities, meaning the business itself isn’t taxed. Instead, profits and losses are reported on the member’s personal tax returns. But, LLCs can elect to be taxed as a corporation if that’s more beneficial for their specific situation.