Key Takeaways

AI has moved from promise to performance. Across industries, companies are no longer debating if AI can create value but they’re demonstrating how fast.

From service and sales to operations and data activation, the rise of the Agentic Enterprise, where humans and AI agents work together, powered by trusted data, is redefining operational efficiency and growth.

At this year’s Dreamforce, our Global Private Equity & Venture Capital Practice welcomed top Private Equity and Venture Capital firms for three days of learning, connection, and inspiration. From a Welcome Breakfast with Salesforce leadership to our annual Value Creation Dinner, the program centered on reimagining value creation in the agentic era and bringing firms together to discuss and learn from each other. Momentum also extended to the Venture Capital community with the debut of Salesforce Launchpad, a new program helping startups scale faster with AI and digital labor, and a dedicated Venture Capital track with founders from CloudFit, Excess Materials Exchange, Metronome, and HappyRobot.

Grow faster with Salesforce Launchpad

Get tailored resources to build your GTM strategy and help your startup scale faster.

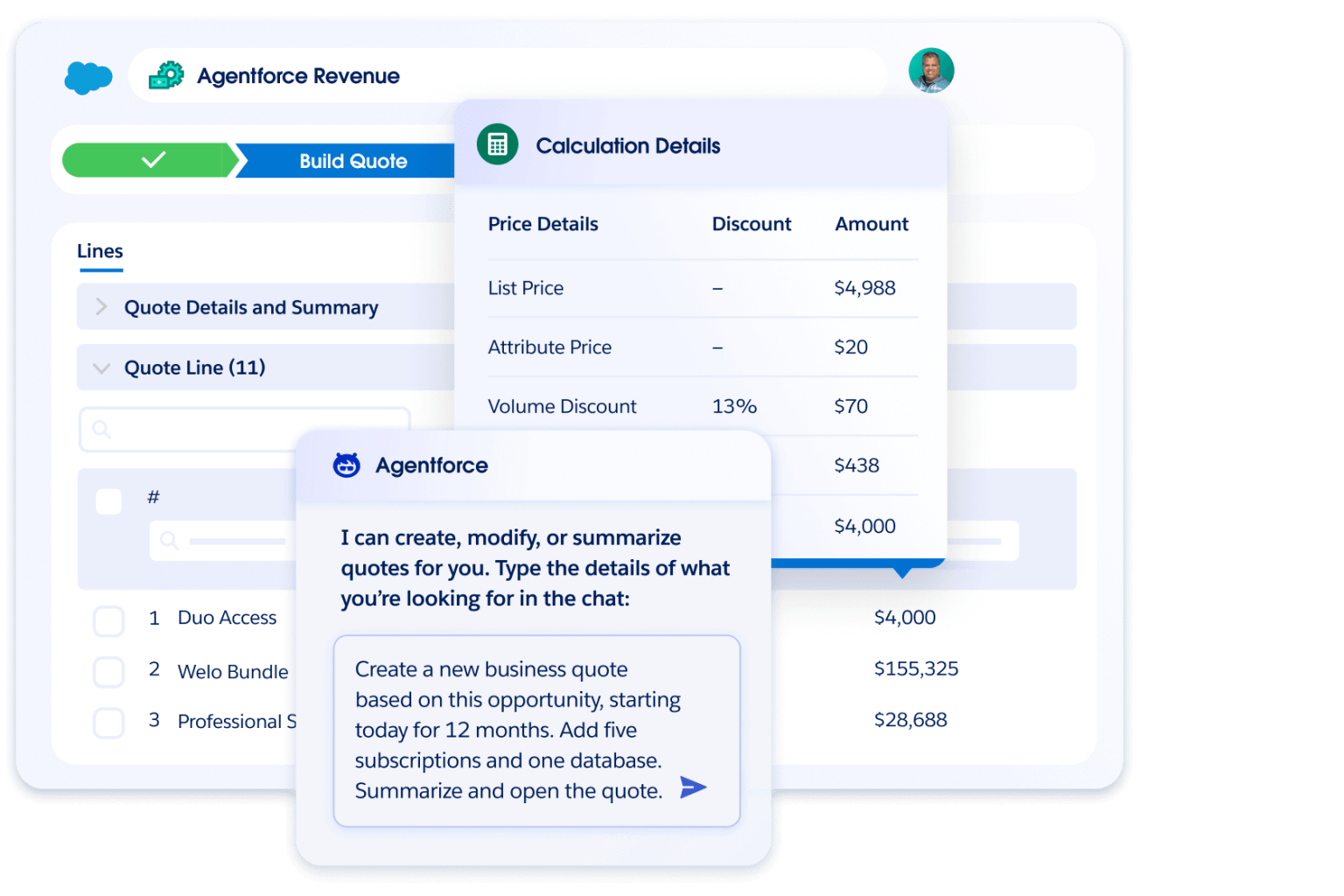

A few highlights that stood out: a fireside chat with Sam Chung, Chief Customer Officer, and Meredith Schmidt, EVP, discussing Agentforce Revenue Management (formerly known as Revenue Cloud), an exit readiness roundtable session, our practice’s own hosted Customer and Operating Partner Panels, and keynote product sessions featuring Agentforce 360, Slack, and Data 360. All together, this year’s content highlighted both the technology and the execution behind it: the blueprint for scaling efficiency, accelerating digital labor adoption, and driving measurable value creation across the portfolio.

Unify sales, finance, and legal on the #1 AI CRM with Agentforce Revenue Management

When sales, finance, and legal are disconnected, the customer feels the pain. Learn how Agentforce Revenue Management can help.

Customer Spotlight and Operating Partner Panel: From Pilot to Portfolio Scale

Our Customer Spotlight and Operating Partner Panels brought some of the most compelling conversations of the week with portfolios CXO’s from Engine, FSA, Smartsheet, and UFL, and Operating Partners from Carlyle and Sixth Street sharing how they’re using Agentforce to accelerate value creation.

The United Football League tackles game day support for fans with Agentforce

Agentforce instantly answers fan questions and turns football data into powerful insights.

The collective insight: start by solving an end to end problem, deliver quick wins, and scale systematically. Success comes down to three fundamentals: internal alignment, support for change (both at the C-Suite support and business leader level), and trusted data focused on solving the problem – don’t boil the ocean! Every speaker emphasized that effective collaboration with Salesforce and partners enabled them to move from pilot to production in weeks, not months.

Equally important, the conversation reframed digital labor as a multiplier of your people’s capacity. When teams harness agentic technology, they unlock new bandwidth for innovation and strategic growth, driving measurable EBITDA improvement across the investment lifecycle.

Product Highlights

Agentforce 360: Bringing Together Humans, Applications, AI Agents, and Data

Agentforce 360 shows just how deeply integrated Agentic AI is into our Sales, Service, Marketing, Commerce, Tableau and Mulesoft products, along with Agentforce Builder,Agentforce Observability, and Agentforce Grid, demonstrated how companies can reason, act, and improve over time, safely and at scale.

For Private Equity backed portfolio companies, this provides a clear path to measurable value creation, with faster implementations, lower operating costs, and scalable digital labor that can be replicated across multiple companies. For Venture Capital backed startups, it accelerates go-to-market execution and operational maturity from the earliest stages of growth, enabling investors and operators alike to move from experimentation to execution with confidence and embed digital labor as a core driver of value creation.

Slack: The Agentic Workspace

The Slack keynote revealed how teams are blending collaboration and automation into one unified workspace. With Salesforce Channels and Agentforce embedded directly in Slack, companies can automate workflows, access CRM insights, and act on opportunities instantly, all within a conversational interface.

A highlight was Agentforce Vibes, a new conversational builder that lets users create apps, workflows, and even AI agents directly inside Slack using plain language, turning the workspace into a true command center where productivity, data, and automation converge in real time. Across the investment ecosystem, Slack’s integration with Agentforce 360 is redefining how work gets done, bringing together people, data, and automation in one connected workspace. It empowers teams to move faster, stay aligned, and turn collaboration into a catalyst for smarter execution and sustained growth.

Data 360: The Trusted Data Engine

Reintroduced at Dreamforce, Data 360 (formerly Data Cloud) reinforced a simple truth: AI is only as effective as the data that powers it. By unifying structured and unstructured data into a single, governed source of truth, Data 360 serves as a harmonization layer that acts on Salesforce data as well as data in external lakes like Snowflake and Databricks. Since it does this virtually without replication, organizations of every size can power predictive insights, automation and personalized experiences with speed and confidence.

New capabilities like Data 360 Clean Rooms allow firms and portfolio companies to collaborate securely on shared datasets—unlocking cross-portfolio insights while preserving privacy and compliance. Whether improving forecasting accuracy, improving reporting speed, or streamlining governance, Data 360 equips investors, operators, and founders alike with the connected data foundation needed to accelerate AI readiness, strengthen decision-making, and drive measurable enterprise value.

Key Takeaways for Private Equity Firms and Portfolio Companies

The ROI Story is Clear

Across both Private Equity backed enterprises and Venture Capital backed startups, one consistent theme emerged: Digital labor is now a measurable value creation lever. Companies are reducing cycle times, accelerating revenue recognition, and achieving meaningful ROI in a single quarter and all through targeted, data-driven AI automation.

Implementation Best Practices

The winning formula is simple: Start by solving an end-to-end problem, prove value fast, and scale deliberately. As discussed in our Customer and Operating Partner panels, the most successful teams began with a single end-to-end problem, staying focused on the specific workflow they needed to improve. Rather than turning projects into large data transformation efforts, they looked at only the data required for that workflow and began there. This approach delivered early wins within a few weeks because they built on existing processes and unlocked embedded capabilities quickly and efficiently.

Operational Efficiency Gains

AI automation is helping deliver measurable impact across both portfolio companies and Venture Capital backed startups whether it’s accelerating supplier onboarding and quote approvals to improving service response times and reducing manual workloads. These are not theoretical gains; they’re real efficiency outcomes and top line revenue growth realized in weeks.

Evolving Role of the Operating Partner

Private Equity firms are shifting the role of the Operating Partner. Rather than acting as advisors, they are now taking on a more active role ensuring every portfolio company has a strong AI strategy that is being implemented and delivering impact and beyond.

Closing Thought

Dreamforce 2025 confirmed that the Agentic Enterprise isn’t a concept, it’s an operating model. With Agentforce 360 as the platform, Slack as the conversational UI, and Data 360 as the engine, portfolio company transformation has never been more achievable—or more impactful. This is an existential moment for Private Equity and Venture Capital. The Agentic Enterprise is ushering in rapid change to Value Creation and making a lasting impact on how businesses of all sizes will grow and thrive.

Unlock what’s next in value creation

Discover customer stories, insights, events, and playbooks redefining the future of Private Equity and Venture Capital.