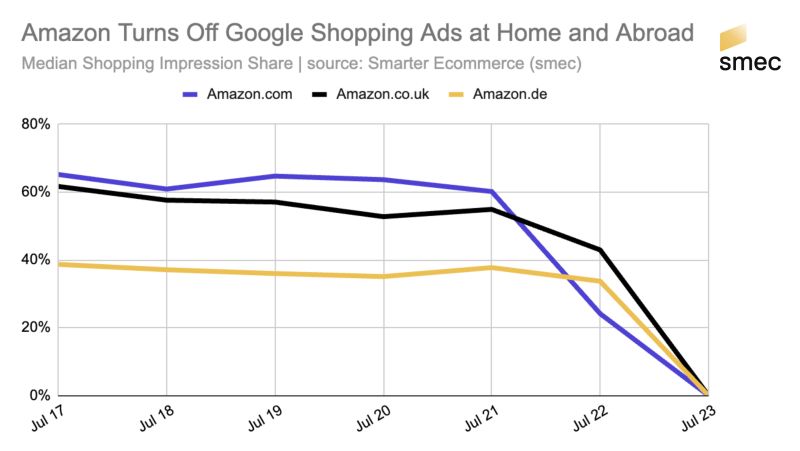

Amazon has abruptly exited Google Shopping ad auctions, a move with significant implications for Alphabet’s ad revenue and retail advertisers worldwide.

Mike Ryan, Head of Ecommerce Insights at SMEC, calls the shift “colossal” and compares it to the dramatic pullback Amazon made during the pandemic lockdowns.

Whats happening. Ryan said about the news:

- “Amazon has made a dramatic international exit from product advertising on Google Shopping. They are a massive source of revenue for Google parent Alphabet Inc., and also serve as a tide that lifts all boats in terms of auction prices. So this has to sting.”

While Amazon has been “cooling” on Google Shopping for about a year, the shift from a slow retreat to a “total stop” is a major inflection point, Ryan added.

Why now. Ryan said the question is why:

- “Because knowing why is the only way we can assess the next question: for how long?” He speculated about reasons ranging from Amazon’s desire to cut funding to Google, to potential internal shifts linked to AI or advertising strategy.

Zoom out. The news might be less exciting for brands and sellers who benefit from Amazon advertising on their behalf, Ryan warned.

- Amazon has historically used Google Shopping as a “Trojan horse” strategy to capture shoppers and bring them into its own ecosystem.

What they’re saying

Several experts commented on this news as well. The report reveals a mix of surprise, speculation, and strategic insights from advertisers.

Surprise at the scale of the exit

Several experts emphasize that Amazon’s disappearance from Google Shopping auctions is unprecedented, with data showing a complete stop across millions of impressions.

Josh Duggan (Co-Founder of Vervaunt):

- “Amazon has officially pulled out of the Google Shopping auction. Interesting one for many to monitor – especially if you’re running Shopping campaigns at scale.

- On average, Amazon appears in ~30% of Shopping auctions across our client base – so this is a big shift.

- CPCs haven’t dropped… but it’s definitely one to review across your own account data and it will be worth keeping a close eye on anyway.”

David Kyle (Senior Paid Media Manager, National Positions):

- “I can’t get them to trigger for anything in the Free Listings, even clients I have that I know are doing volume on Amazon. It’s as if they have completely disconnected from Merchant Center.”

Speculation on timing and strategy

Duane Brown (CEO & Head of Strategy, Take Some Risk)

- “This is interesting and I imagine they will come back. Is this something related to Amazon Prime Day pause and they come back from September and back-to-school buying in another week? I imagine back-to-school buying is huge on Amazon.”

William Julian-Vicary (CTO, Clarity):

- “Are we set to see another case study like the great case studies before them from the likes of eBay and Airbnb? Amazon isn’t exactly a great brand to study for typical user behaviour, but the outcomes from tests like this are rich with data and we can only hope they’ll share some of the learnings that they get from a switch off of this scale – significant move from Amazon!”

Opportunities for competitors

Brandon Yann (Sr. Manager of Client Services & Strategy):

- “Now is the perfect time for brands and agencies to run their own Google Search to Amazon ads with attribution, since they no longer get free coverage via Google Shopping Ads from Amazon.”

Market-wide impact

Robin Yarwood (Google Ads & Social Media Expert):

- “What territories are you looking at, my friend, is that all markets? What’s the outcome you’re predicting, cheaper CPCs for bigger players?”

To which Ryan confirmed the withdrawal spans 20 international Amazon domains, affecting all observable markets.

Why we care. Amazon’s exit from Google Shopping removes one of the biggest and most aggressive competitors in ad auctions. This could lead to lower CPCs, higher impression share, and improved click-through rates for other retailers and brands.

It also opens up a window for competitors to capture traffic and sales that Amazon would typically dominate, creating a short-term advantage and a strategic opportunity to test new campaigns while the auction dynamics shift.

Bottom line. Amazon’s sudden retreat from Google Shopping is shaking up the ad ecosystem. For now, competing retailers stand to gain, but the real question remains: is this a temporary pause or a long-term strategy shift?