Google’s AI Overviews have reshaped search almost overnight. For paid search marketers, the fight for above-the-fold visibility is no longer just about ad rank – it’s now a push to appear above the AI result itself.

This shift follows the rapid surge in AI Overviews that Adthena highlighted in our previous study. That analysis showed AI Overviews quickly moving beyond informational queries and into shorter, high-volume commercial searches.

The mechanism behind this decline is clear: AI Overviews intercept attention, cut click-through rates (CTRs), and push both organic and paid listings lower on the page. The result: fewer clicks and less revenue.

Adthena’s new research pinpoints how often advertisers win ad placement above AI Overviews across seven major industries, device types, and query categories. The findings reveal clear winners and uncover opportunities that paid search teams can act on now.

The topline reality: Ad position visibility is lost 25% of the time

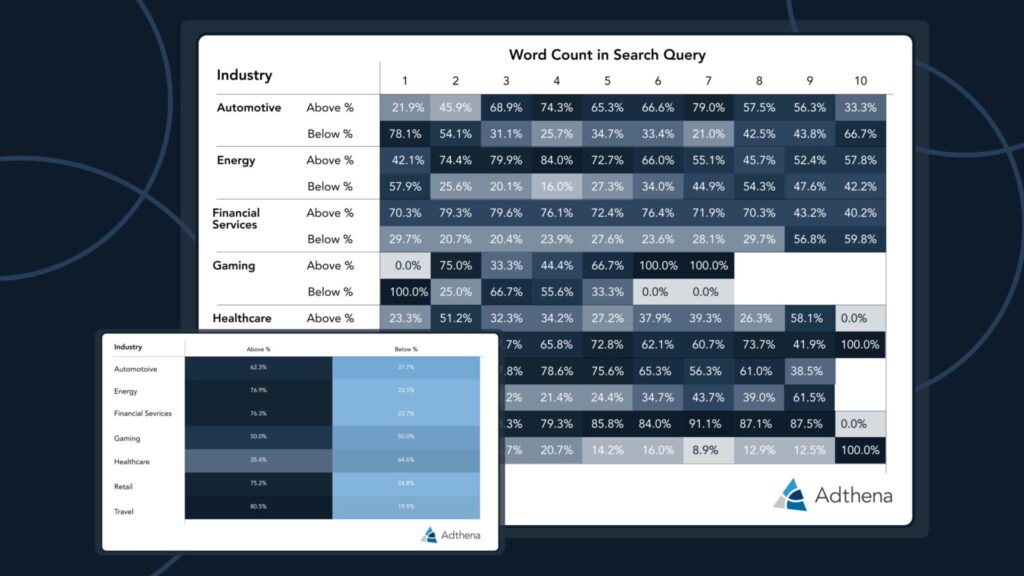

The summary table below offers a crucial industry benchmark for the battle over the top spot, showing the percentage split of ads appearing above or below AI Overviews across seven industries.

Strategic implications from the topline data

- The leaders: Industries like Travel, Energy, Financial Services, and Retail consistently land above the AI Overviews in more than 75% of appearances. That still means 1 in 4 paid ads are affected by AI Overviews across major sectors. For keywords that drive millions in revenue, this 20% to 30% exposure creates immediate, high-cost instability that directly threatens ROI.

- The runners-up (the risk of being hidden): Healthcare stands out as the clear outlier, with ads appearing below the AI Overviews 64.6% of the time. Because healthcare searches are high-stakes and research-heavy, Google’s AI tends to dominate the SERP to deliver “expert” information first. That choice severely limits ad visibility and wipes out nearly two-thirds of the new above-the-fold space.

- The volatility: Gaming shows a clean 50/50 split. In this vertical, visibility becomes a coin flip, reinforcing the need for highly dynamic bidding strategies.

The device divide: Why mobile is your biggest threat

Device Split data over a snapshot one-week period reveals that the risk of ads being pushed below the AI Overviews is heavily exacerbated by the mobile environment, where SERP real estate is severely compressed.

Strategic implications on device differences

- Automotive’s Mobile Problem: While Automotive shows a solid overall “Above %” rate, the daily trends tell a different story. On mobile, ads are pushed below the AI Overviews nearly half the time. And on a small screen, an ad buried under a long AI Overview is often invisible without a full scroll. That drop in placement leads to lower visibility and CTR.

- The “double whammy”: For industries like healthcare, desktop ads sit below the AI Overviews most of the time, while mobile performs slightly better. This suggests the AI Overviews box may be tuned for mobile screens in a way that occasionally leaves one or two ad slots visible, but the desktop view is still dominated by AI. Marketers need to tailor their creative to the narrow window of opportunity available on the mobile SERP.

- Actionable insight: Mobile is where the disruption from AI Overviews hits hardest. For industries like healthcare and gaming, where the mobile “Below %” rate is disproportionately high, securing top ad rank becomes a matter of screen survival.

The query intent test: Where does AI Overviews win and lose?

In general, long queries (high word count) tend to be informational and more likely to trigger AI Overviews. Short queries (low word count) are usually transactional. The table below, however, exposes a counterintuitive industry pattern.

This table shows the relationship between query complexity (user intent) and AI Overviews dominance across query lengths from one to 10 words.

Strategic implications on query intent

- AI Overviews dominance on the fringes:

- Healthcare shows a clear pattern: as queries become longer (10 words), the ad’s position above the AI Overviews drops to 0.0%. This confirms that Google views complex health-related questions, pushing all commercial intent below the scroll.

- Gaming is the opposite: short terms (1-2 words) see 0.0% visibility above the AI Overviews, suggesting a SERP feature (like a pack or video) or a strong organic result is claiming the top spot, forcing the ad below the AI Overviews. However, on long terms (Word Count 7-9), ads take 100% of the above-AI Overviews space. This is a massive opportunity to intercept users in the deep research phase.

- The unexpected paid search opportunity (Automotive & Travel):

- In industries like Automotive and Travel, ads actually perform better on longer, more informational queries than on short, high-volume terms. For Automotive, the “Ad Above AI Overviews” rate jumps from 21.9% (1 word) to over 74% (4 words).

- Strategic implication: This challenges the traditional PPC strategy. Instead of avoiding informational keywords where AI Overviews are present, paid marketers should be aggressively bidding on these mid-to-upper-funnel queries, as the ad position relative to the AI Overviews is highly favorable, allowing them to intercept the user’s journey before a final decision is made.

Next steps for paid search marketers

Adthena’s study confirms the Google AI Overviews threat is segmented. The best strategy is precision: know when and where your ads beat the AI Overviews position and adjust bids and creative.

While this is still early data, as AI Overviews frequency continues to increase, this percentage of ad position might change. We recommend you regularly audit profitable keywords to proactively manage visibility in the changing AI search landscape.

Here are three critical, actionable next steps for paid search marketers:

1. Have you explored testing a device-specific strategy?

The data shows that mobile devices often magnify visibility loss from AI Overviews, especially in categories like automotive.

Consider testing a device-specific campaign strategy, particularly for campaigns hit hardest by AI Overviews cutting into ad visibility.

2. Have you identified quick wins in keyword coverage?

The word count data reveals some counterintuitive opportunities. In industries like Gaming and Automotive, long-tail informational queries (four or more words) are where ads often secure strong placement above the AI Overviews.

That means there may be high-visibility traffic in mid- to upper-funnel searches that your competitors are overlooking.

3. Have you reviewed your ad copy against the AI answer?

AI Overviews often miss brand nuances and emotional cues.

To earn the click, your ad must do what the AI cannot: give users a clear, compelling, and urgent reason to leave Google’s summary and choose you. Messaging that highlights trust, guarantees, or speed can break through AI’s generic tone.

Focus your copy on transactional hooks such as deals, free shipping, limited-time offers, or scarcity (“12 hours left to buy”). Build trust and emotion with human-centered elements like customer service, testimonials, and your unique brand story.

The SERP has changed. The data shows that marketers who gain real-time, granular visibility into their ad position relative to AI Overviews – and act on it – will be the ones who succeed in this new paid search landscape.

Ready to see where your ads sit today?

Adthena shows exactly when your ads appear above or below AI Overviews, so you can stay ahead of how AI Search is disrupting performance. Book a demo to see where you stand on the SERP.