For most financial services firms, there’s a huge, risky gap.

On one side, you have your compliance team, buried in dense regulatory documents and policy manuals. On the other side, you have your frontline bankers, advisors, and service agents, both human and digital, just trying to help customers and grow the business. How do you ensure the rules from those manuals are followed on every single customer interaction?

Key Takeaways

- Manually checking for compliance with spreadsheets and spot-checks is risky, expensive, and slows down business.

- Process Compliance Navigator embeds preventative controls directly into your core workflows, helping to validate rules consistently for both humans and AI-powered agents.

- This transforms compliance from a separate, reactive audit function into an automated, proactive, and invisible part of your daily operations.

The traditional answer has been manual checklists, human reviews, endless spreadsheets, and stressful “after-the-fact” spot-checks. This reactive approach isn’t just inefficient; it’s risky. It means you don’t find a problem until after it’s already happened. This slows down business, creates friction for customers, keeps Chief Compliance Officers and Risk Managers awake at night, and can result in significant fines plus reputational damage.

What if you could close that gap? What if you could move compliance out of the back office and directly into the frontline workflow? What if you could prevent a non-compliant action from happening in the first place, with guidance appearing in real-time?

Introducing Process Compliance Navigator

Process Compliance Navigator is an integrated compliance platform, built natively on Salesforce, designed to bridge the critical gap between tracking regulatory mandates and executing business processes (which is where the risk actually lives). It transforms compliance from a separate, manual roadblock into an automated, seamless part of how you build and maintain customer relationships.

Instead of just auditing what happened yesterday, you can now prevent violations before they happen.

Weave Compliance into Your Workflows

Process Compliance Navigator gives you a framework to turn your policies into automated actions:

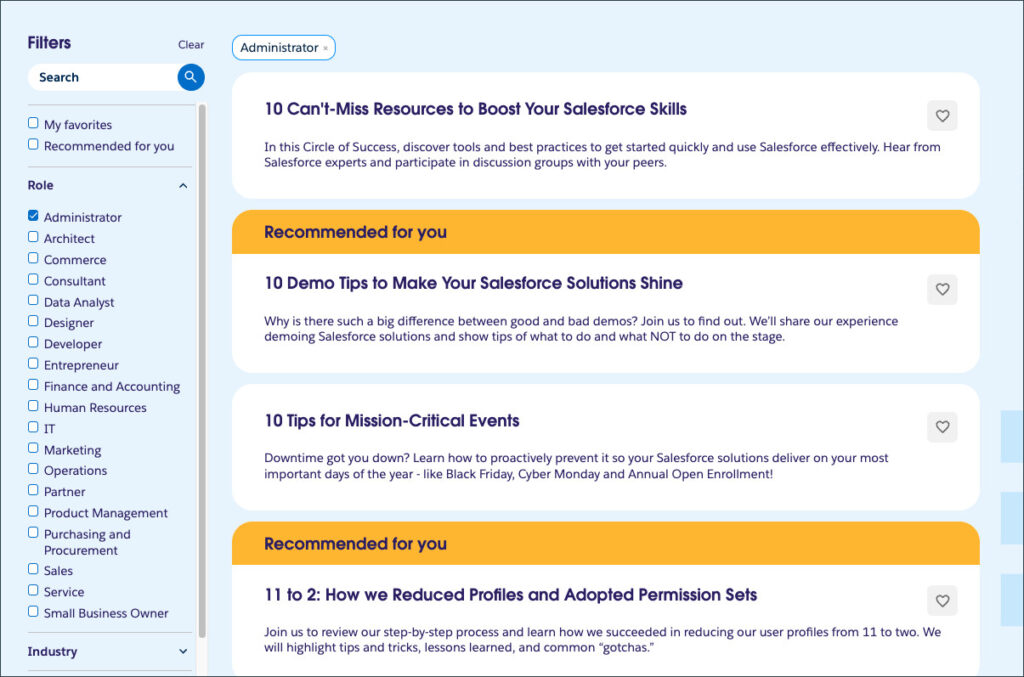

- Automate Compliance with AI: Keeping up with the ever-changing regulatory environment is a manual-heavy challenge. AI automates this process by ingesting complex regulatory documents and translating that dense legal text into a centralized, actionable library of clauses. This gives you a single source of truth for all your policies and procedures which can be versioned directly in Salesforce. But having the rules in one place is just the first step; now you have to make sure everyone can follow them.

- Prevent Violations in the Flow of Work: This is where you translate those rules into real, preventative controls. Your compliance and ops teams can use low-code and AI tools to build these controls and embed them directly into any business process, inside or outside of Salesforce. The result? When the workflow runs, the user – whether a human or an AI agent – is prevented from moving to the next step if there’s a rule violation. The system doesn’t just say “no”; it provides the exact action needed to get it right. The payoff: the control runs inside the flow, and every action is logged, creating an immutable audit trail.

- Prove It in Minutes: Finally, you can prove it. You get a single source of truth for your entire compliance framework. This allows you to prepare for audits and regulatory exams in minutes, not weeks, with real-time compliance reporting. When a regulator asks, “Can you prove you’re compliant?” you can show them real-time dashboards and a complete log of every check performed.

Process Compliance Navigator is finally closing that risky gap between your policies and your frontline by turning compliance from a manual, after-the-fact checklist into an automated, invisible part of the action itself, ensuring every decision your human and AI agents make is consistent and auditable.

Start simplifying your compliance today.

Embed your controls directly into your business processes, automate proof of compliance, and free your teams to focus on what matters most: growing your business with confidence they are following the rules.